Analytics in BFSI domain gives different views to company’s financial data. every business should have financial planning and forecasting to successfully run the business. Financial analytics gives detailed information about data and helps in predicting future objectives. Financial analytics helps is making important decision to gain business profits.

Churn analysis, segmentation, forecasting and predictive analysis these are the most crucial operations in BFSI domain.

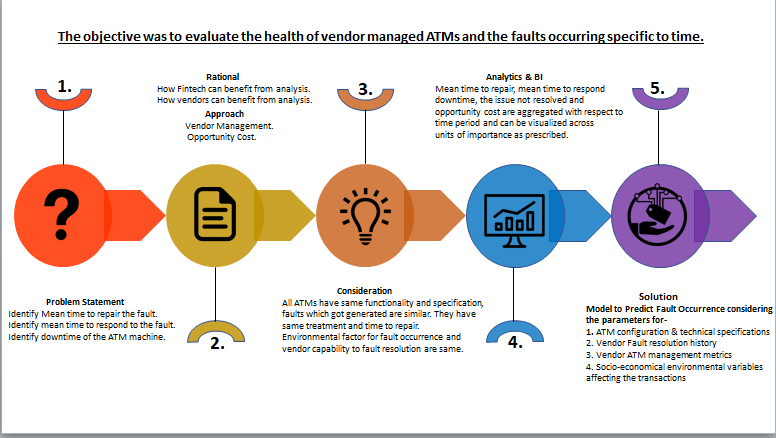

One of our use case shows how analytics is used in the large FinTech industry, as follows

Scenario

Identifying health of vendor managed ATM’s is critical task but using predictive analytics, Issues resolution analysis, analysis of the Issues across Vendors and machine learning health of the ATM’s can be identified. This gives realistic vendor performance, assess the business loses to enhance the customer experience and customer demand.

Methodology

Using business intelligence dashboards mean time to repair fault and mean time to respond to the fault is calculated, using possible predictive analysis pattern is recognized for different faults like vendors ability to handle multiple issues and model has been created for predict fault occurrence considering ATM configuration, technical specification, vendor fault resolution history and vendor ATM management metrics.

Benefits

This not only helped in reduce the occurrence of undesirable situations, but also significantly improved the overall customer experience at a much-reduced operational cost.